do nonprofits pay taxes on rental income

But some businesses use the accrual method of accounting. When the IRS reclassifies rentals as not-for-profits the rental income and expenses must be reported differently than ordinary rentals resulting in a severe loss of tax.

Irs Form 9465 Can T Pay Your Taxes All At Once Read This Irs Forms Irs Payment Plan Irs

Taxable if Income from any item given in exchange for a donation that costs the.

. While most US. This method requires you to report income as you receive it and expenses as you pay them out. June 30 2021.

In general those who rent out a property for 15 days or more out of the year must pay taxes on rental income. Organizations granted nonprofit status by the Internal Revenue Service IRS are generally exempt from tax they must pay some types of taxes under certain. Tax Exempt if All unrelated items eg snacks and drinks Minimum Suggested Donation items.

Just because you have a tax-exempt status it does not mean that youre well tax. Nonprofits are usually exempt from paying corporate income taxes on unrelated business income UBI but they must pay them under both state. Do nonprofit organizations have to pay taxes.

Your recognition as a 501 c 3 organization exempts you from federal income tax. Did you know that sometimes nonprofits must pay income tax. While nonprofits are generally tax-exempt they must pay income tax when operating outside the scope of their exempt purposes.

Report rental income on your return for the year you. But some businesses use the accrual method of accounting. However this corporate status does not.

Did you know that sometimes nonprofits must pay income tax. But if you rent out a property for only 14 days or fewer out of. But determining what are an.

Non-profit status may make an organization eligible for certain benefits such as state sales property and income tax exemptions. If you are 65 years old or older and your net income the previous year wa s 10000 or less you qualify for a 4000 property tax. Do Non Profits Pay Taxes.

Yes nonprofits must pay federal and state payroll taxes. But nonprofits still have to pay. However here are some factors to consider when.

Most nonprofits do not have to pay federal or state income taxes. Yes nonprofits must pay federal and state.

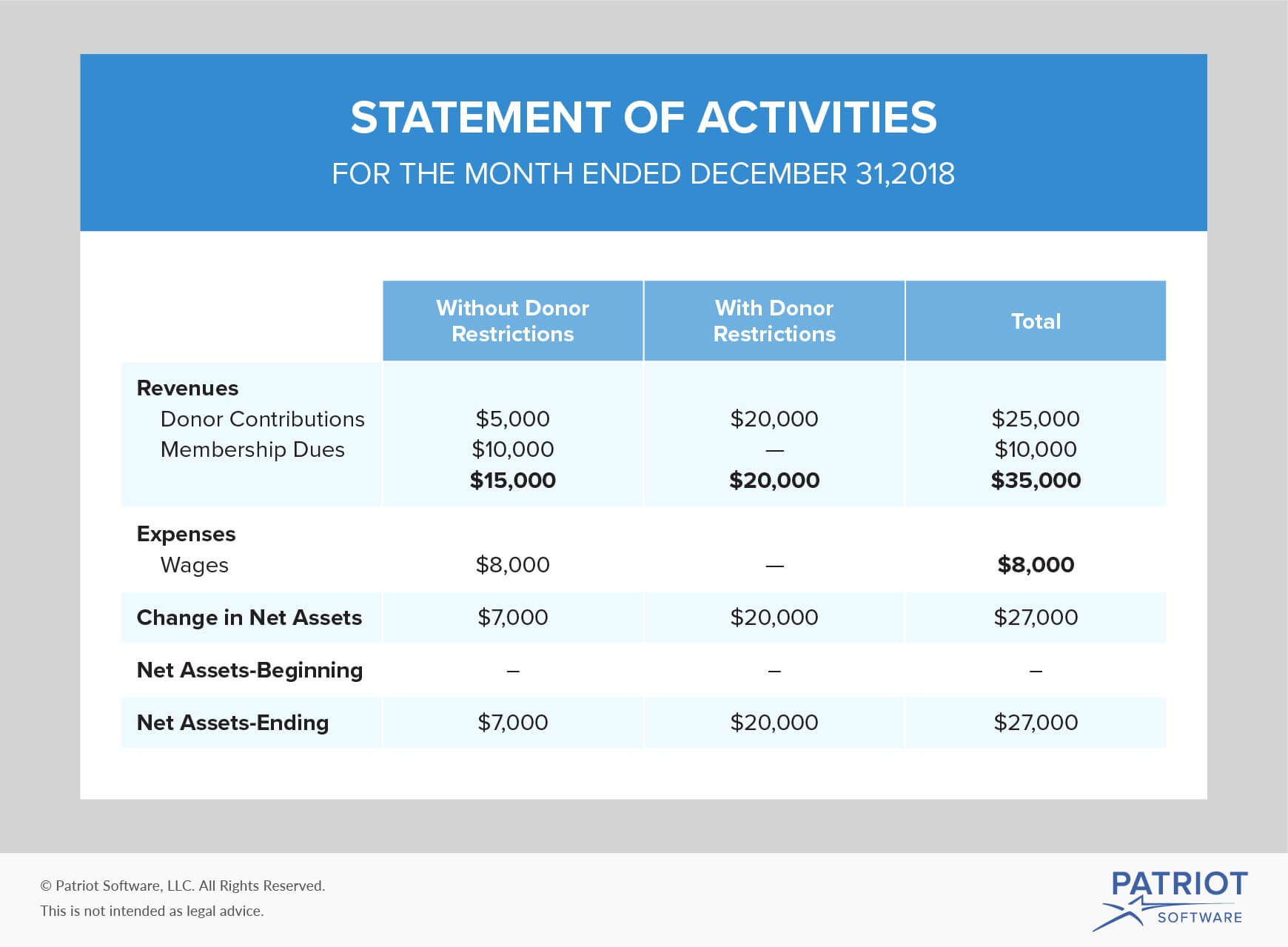

Accounting For Nonprofit Organizations Financial Statements Beyond

Common Ubit Myth Related To Nonprofit Revenue And Tax Impact Nonprofit Accounting Basics

Tax Information Nonprofits Renting Extra Space Church Facility Solutions

Irs Form 990 Filing Instructions And Requirements For Nonprofits

Common Nonprofit Unrelated Business Income Types

501 C 3 Vs 501 C 4 Key Differences And Insights For Nonprofits

Property Tax Exemptions For Nonprofits Blue Co Llc

Taxable Activities Of Nonprofits A Basic Guide To Ubit Wegner Cpas

Nonprofit Chart Of Accounts Template Double Entry Bookkeeping In 2022 Chart Of Accounts Accounting Downloadable Resume Template

Unrelated Business Income Tax Ubit For 501c3 Nonprofits

501 C 3 Vs 501 C 4 Key Differences And Insights For Nonprofits

Nonprofit Accounting How Not For Profit Organizations Can Prepare For An Non Profit Nonprofit Fundraising Profit

Accounting Spreadsheets And Document Examples Nonprofit Accounting For Volunteers Treasurers And Bookkeepers In 2022 Bookkeeping Accounting Non Profit

How To Make Your Nonprofit Facebook Page Great In Under Five Hours Non Profit Fetal Alcohol New Facebook Page

Is Your Nonprofit Giving Away Things It Should Charge For Nolo

Keys Receipts Being A Landlord Tenants Rental Property Management

Beginner S Guide To Rental Income For Non Profits Taxable Or Not Blue Co Llc